The Asia Corporate Payment Survey, conducted by Coface between November 2022 and April 2023, provides insights into the evolution of payment behavior and credit management practices of about 2,300 companies across the Asia Pacific region. Respondents are active in nine markets (Australia, China, Hong Kong SAR, India, Japan, Malaysia, Singapore, Taiwan and Thailand) and 13 sectors.

Increase in payment delays

The survey revealed that overall, fewer businesses reported overdue payments in 2022. Indeed, the share of companies reporting overdue payments fell to 57% in 2022 - the lowest in 10 years - from 64% in 2021. Nevertheless the duration of payment delays across Asia-Pacific increased markedly, as businesses were more restrictive with credit terms amid aggressive rate increases, tighter financial conditions and higher inflation. The average payment delay lengthened from 54 days in 2021 to 67 days.

Sector-wise, seven of the thirteen sectors in the survey registered longer average payment delays. Overdue payments increased the most in retail (+15 days), pharmaceuticals (+10.5 days), and energy (+10 days). The energy and construction sectors posted the longest average payment delay at 77 days. On the other hand, agrifood and textile saw the shortest payment delays with a drop from 60 days in 2021 to 52 days in 2022.

According to Coface’s experience, 80% of overdue longer than 6 months (ultra-long payment delays /ULPDs) are never paid. Therefore, cash-flow risks arise when these ULPDs account for over 2% of a company’s annual revenue.

The survey shows a decline in the proportion of respondents experiencing ULPDs exceeding 2% of their annual revenue, falling from 34% in 2021 to 26% in 2022. Despite an improvement in most Asian countries, the situation in Australia was different as the proportion of respondents with such ULPDs expanded from a high level of 56% in 2021 to 63% in 2022. Malaysia also faced a rise in cash flow risk with the percentage rising from 0% in 2021 to 26%. Overall, the situation could deteriorate in the month to come as corporate insolvencies rose in Japan, Korea, Australia, Hong Kong and India in the 1st half of 2023.

An increase in the price of raw materials

39% of respondents explained that rising price of raw material was the factor that impacted the most their sales and cash flow in 2022. Other factors were disruptions to operations due to lockdown measures leadingto an insufficient workforce (27%) and a decline in demand (20%). Elevated commodity prices, notably energy prices, high interest rates and tight financial conditions, as well as weak global trade demand, are expected to curb business activity in 2023.

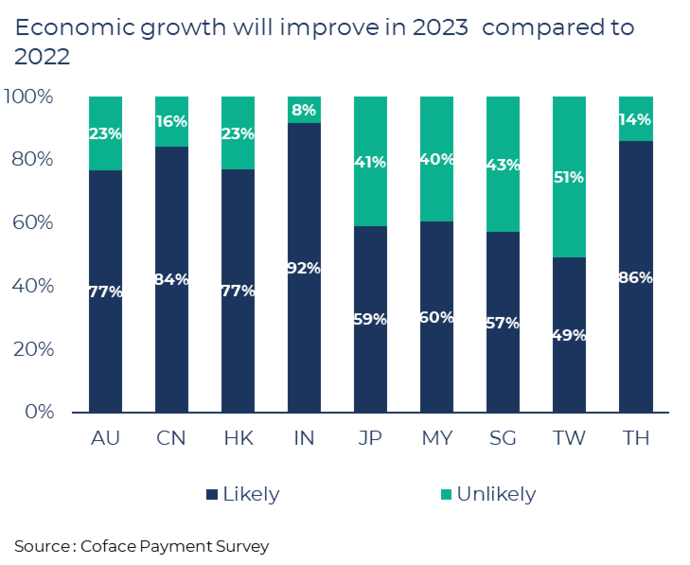

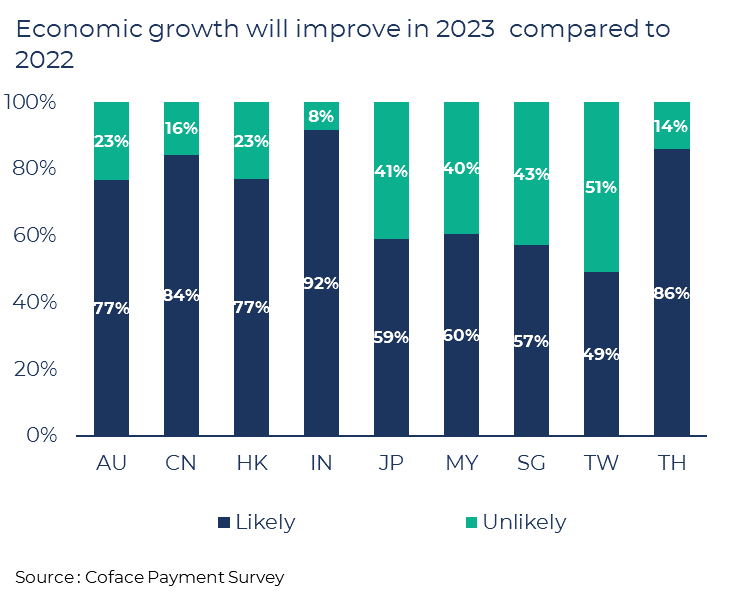

Prospects for 2023 appear to have brightened, with 77% of respondents expecting economic growth to improve in 2023.India and Thailand companies were the most optimistic economies with 92% (+9.4 ppts from 2021) and 86% (+5.6) of respondents anticipating higher growth. Companies in Hong Kong and China, where lockdown measures were only dismantled in late 2022, expressed more confidence in greater economic growth for 2023, with the proportion increasing by 23.7 ppts to 77% in the former and by 16.3 ppts to 84% in the latter.

This last survey reflected an improvement in payment experience for companies in Asia in 2022. However, the continuation of the war in Ukraine, escalating US-China technological rivalry, subdued demand in the US and European markets, high inflation, and aggressive interest rate hikes that contributed to tighter monetary and financial conditions, will continue to weigh on Asian consumers and businesses in 2023. Coface forecasts that economic growth in Asia will only accelerate slightly at 4.5% in 2023.

- Bernard Aw, Chief Economist for Asia-Pacific at Coface