科法斯于 2025 年第一季度进行的亚太企业付款调查揭示了亚太地区约 2400 家企业付款行为和信用管理实践的发展演变。受访企业活跃于 9 个市场(澳大利亚、中国大陆、中国香港、中国台湾、印度、日本、马来西亚、新加坡和泰国)和 13 个行业。

- 2024 年平均信用期限为 65 天,较 2023 年的 64 天略微增长。

- 2024 年平均逾期付款天数与 2023 年持平,仍为 65 天,但出现逾期付款的企业比例下降至 49%。

- 遭遇超长逾期付款 (ULPD[1]) 超过年营业额 2% 的企业比例,上升至 40% 的新高,明显高于 2023 年的 23%。木材、农产品和汽车行业增幅最为显著。

- 57% 的企业预计未来六个月付款行为将恶化,并认为需求放缓、竞争压力和成本上升是主要风险因素。

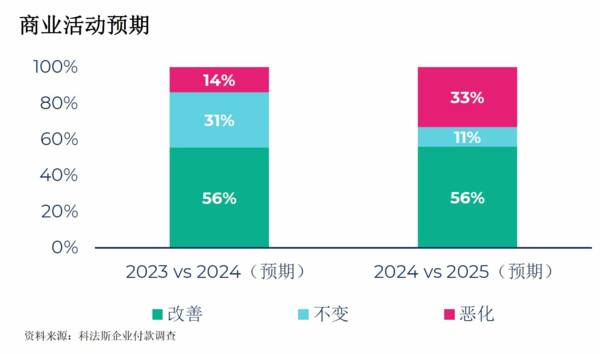

- 33% 的企业预计 2025 年业务前景将恶化。

[1] 逾期付款超过 180 天且超过年收入的 2%

“由于全球需求增长缓慢、成本上升和高利率环境,亚太地区 2024 年经济增长已经放缓。超长逾期付款创出新高,预示着企业将面临日益严重的财务压力。叠加关税上涨,企业正为更动荡的贸易和政策环境做准备。我们已将亚洲 2025 年的 GDP 增长预测修正为 3.8%。” 科法斯亚太区首席经济学家欧韦良(Bernard Aw)表示。

信用条件依然紧张,未来可能进一步收紧

与 2023 年之前相比,2024 年信用条件依然紧张。2024 年信用期限从 2023 年的 64 天延长至 65 天,但低于 2018-2022 年五年平均值 69 天。

受访的 13 个行业中,有 10 个行业的信用期限在 2024 年有所延长。汽车行业增幅最为显著,其次是纺织和化工。汽车市场竞争激烈,促使经销商在提供信用期限方面更加灵活,并将其作为竞争手段。

展望未来,三分之二的公司预计信用期限将缩短,反映出在高度不确定性的环境下,企业更加谨慎,更重视现金储备。

超长逾期付款创新高令人担忧

平均逾期付款天数保持稳定,为 65 天,与 2023 年持平。

运输和汽车行业报告逾期付款有所增加(分别比 2023 年增加 2% 和 1%)。

然而,表示遭遇超长逾期付款(逾期付款超过 180 天且超过年营业额的 2%)的企业比例大幅上升至 40%,明显高于 2023 年的 23%。根据科法斯的经验,80% 的超长逾期付款无法收回,预示企业的现金流风险极高。此类逾期付款在中国、印度、泰国和马来西亚最为严重。所有 13 个行业 超长逾期付款 均有所增加,其中木材(增加 37%)、农产品(增加 20%)和汽车行业(增加 18%)增幅最为显著。

预计这一趋势将在未来六个月持续下去,因为 57% 的企业预计逾期付款情况将恶化。

展望:贸易政策转变将影响经济景气

我们预计 2025 年的经济前景将持续恶化。高涨的关税和变化莫测的贸易政策,增加了全球经济政策的不确定性,严重影响企业支出和消费者信心。此外,企业还面临过度竞争压力、需求放缓、劳动力成本上升等风险。

33% 的受访企业预计 2025 年(与 2024 年相比)商业活动将恶化,是去年调查的两倍多。中国台湾和新加坡最为悲观,超过40%的受访企业预计商业活动将恶化。

“由于需求疲软,2024 年亚太地区经济增长放缓。去年的贸易量虽有回升,仍不足以弥补 2023 年的下降。面对地缘政治不确定性持续加剧,以及成本不断上升,预计许多企业将加强信用管理,着力控制成本。”科法斯亚太区首席经济学家欧韦良表示。

> 下载新闻稿

> 下载完整中文报告

[1] 逾期付款超过 180 天且超过年收入的 2%